Lise, a mother with two kids who works at a college, and her brother Dan, a lawyer, compare how the 2017 provincial budget has affected them in the last year.

Lise, a mother with two kids who works at a college, and her brother Dan, a lawyer, compare how the 2017 provincial budget has affected them in the last year.

This budget was a major fail for housing affordability in Saskatchewan.

In the recent Saskatchewan budget, the Moe government made the surprise announcement that it would slowly phase out a rental housing assistance program known as the Saskatchewan Rental Housing Supplement. Given current rental housing market realities, the government ought to have done the complete opposite and expanded the program.

That’s because high vacancy rates create a desirable climate in which to provide rental assistance to tenants, which can ultimately reduce costs for other sectors of government.

More than 50,000 households in Saskatchewan experience core housing need, meaning that, by no choice of their own, they either pay more than 30 per cent of their income on shelter, live in housing requiring major repairs or live in housing with too few bedrooms.

That represents more than 13 per cent of all Saskatchewan households — and for Indigenous peoples, the rate is nearly double.

When rental vacancy rates are low — in Saskatchewan, this was the case when potash and oil prices were high — some landlords can demand more money and be selective. They can charge higher rents because jobs are plentiful and they can be picky because they have more choice who they rent to.

But rental vacancy rates are high right now. Across the province, they’re nearly 10 per cent on average. In such a context, landlords are more desperate to rent their units.

In other words, it’s more effective to fund and deliver rent supplements in times of high vacancy rates because each dollar spent by government gets the tenant more for their housing dollar on the private market.

That time is now.

Yet, as of July 1, the Saskatchewan government will accept no further applications for the Saskatchewan Rental Housing Supplement.

This will make life very difficult for low-income households, especially those receiving social assistance. Social assistance in Saskatchewan provides a single, disabled adult with less than $16,000 annually on which to live (for rent, food and other necessities). That’s where the province’s rent supplement program has been helpful. Households currently qualifying for the program receive between $61 and $364 monthly, which supplements the meager social assistance benefits they receive.

Approximately 13,000 people across Saskatchewan currently use this rent supplement.

To qualify, an individual must have a disability or at least one child in their care.

This is not the time to phase out the program. Rather, it’s the time to expand it. Not only can this help vulnerable people; it can also help taxpayers.

By underinvesting in housing for low-income households, health outcomes for those households can deteriorate — which becomes especially clear when people become homeless.

The most comprehensive health survey ever conducted on the homeless in Canada found that persons experiencing absolute homelessness are more than 10 times more likely than the general population to suffer from anxiety, 20 times more likely to have epilepsy and nearly 30 times more likely to have hepatitis C.

Homelessness and poor health outcomes lead to further health care costs for government. For example, it can cost $1,000 a night to keep a person in a hospital bed — vastly more than it costs in Saskatchewan to provide that same person with a rent supplement for an entire month.

The announced phase-out of this program took community stakeholders by surprise.

And how will it actually help taxpayers? It’s projected to result in short-term savings to the provincial government of $5 million annually (or 0.03 per cent of the total budget) — a meagre amount in the overall budget.

Yet, these short-term savings could well be offset and then some by costs associated with increased homelessness.

Governments need to read market signals, understand the downstream consequences of underinvestment and respond accordingly with good public policy. On that score, this budget was a major fail for housing affordability in Saskatchewan.

Nick Falvo is a research associate at the Carleton University Centre for Community Innovation and an expert advisor with EvidenceNetwork.ca. He has a PhD in public policy and is based in Calgary.

On April 10, the Saskatchewan government tabled its 2018-19 budget. Here are 10 things to know:

In Sum. This budget, while relatively status quo, is mostly bad news for low-income households in the province. And this comes one year after a budget that announced significant cuts to social programs.

The author wishes to thank Daniel Béland, Simon Enoch, Dionne Miazdyck-Shield and one anonymous reviewer for invaluable assistance with this blog post. Any errors lie with the author.

Nick Falvo is Director of Research and Data at the Calgary Homeless Foundation. You can follow him on Twitter at @nicholas_falvo.

As the second largest oil-producer in the country and home to a government that has vigorously promoted the oil industry and firmly opposed carbon pricing, one might assume that the Saskatchewan public is relatively united in their support for fossil fuel extraction. Winds of Change: Public Opinion on Energy Politics in Saskatchewan by Andrea Olive, Emily Eaton and Randy Besco demonstrates that the Saskatchewan public may not be as wedded to a future with fossil fuels as we might think. This report presents some surprising results of public opinion polling of 500 adult Saskatchewan residents on issues of oil extraction, environment, and climate change in the province. The results show that people living in Saskatchewan support a transition away from fossil fuels and agree that the government should invest more in solar and wind power while strengthening environmental regulations. The results of this study indicate that there is more room in the province for discussion around energy issues than is often assumed. Opinions could be changing in the province and politicians would be smart to invest in long-term strategic thinking about a transition to alternative energy.

Andrea Olive is an associate professor of political science and geography at the University of Toronto Mississauga. She is the author of two books, Land, Stewardship and Legitimacy: Endangered Species Policy in Canada and the United States and The Canadian Environment in Political Context. Her main areas of research include wildlife conservation, Canada-US environmental policy, and the environment-energy nexus.

Emily Eaton is an associate professor in the Department of Geography and Environmental Studies at the University of Regina. She is the author of two books, Fault Lines: Life and Landscape in Saskatchewan’s Oil Economy (with photographer Valerie Zink) and Growing Resistance: Canadian Farmers and the Politics of Genetically Modified Wheat. Her main areas of research include natural resource economies, especially oil and agriculture, and ecology.

Randy Besco is an assistant professor of political science at the University of Toronto Mississauga. He is the author of a forthcoming book entitled Interests and Identities in Racialized Voting. His main areas of research are elections and public opinion.

For those that feared that the Saskatchewan government would continue the punishing austerity they laid out in 2017, this year’s budget came as a mild relief. While the 2018 budget doesn’t restore the cuts made last year, the government appears to have opted for holding the line – offering no major tax increases while avoiding the litany of program cuts that outraged the public in the previous budget.

One of the first rules of politics is to define yourself before your opponent does it for you. This budget was the first act of newly-minted Premier Scott Moe’s government that was guaranteed to receive public attention, and for a Premier who has yet to define himself or his government, replicating what was widely seen as a mean-spirited and unfair 2017 budget would have been to court political disaster. That a politician as adept as former Premier Brad Wall could not sell austerity to the public last year left little chance that a relative unknown like Scott Moe could. Certainly, this budget was a defining moment for Moe and his government, and they appeared unwilling to wear the public opprobrium that would have inevitably resulted from a continued slash and burn approach to the budget.

That being said, while the 2018 budget is more measured in that it doesn’t replicate a 2017 budget that saw cuts and tax increases land disproportionately on the shoulders of the poor while simultaneously lavishing multiple tax breaks on corporations, it certainly doesn’t do the more vulnerable in our province any favours. The province is suspending the Saskatchewan Rental Housing Supplement (SRHS), which will force the poorest in the province to devote even more of their meagre earnings towards rent. This continues the government’s myopic focus on wrenching cost-savings from programs explicitly designed to support the poorest in the province. While the government did increase education spending by $30 million, it restores little more than half of the $54 million that was cut last year. School boards will be forced to find even more “efficiencies” in the classroom, even as student enrolment expands. As we have seen in the past, these “efficiencies” seem to fall disproportionately on special needs supports and programs.

If there is a small sliver of a silver-lining in this budget, perhaps it’s the government’s growing recognition that austerity during a downturn is bad economic policy. It’s better to allow positive economic growth fight your deficits than deep cuts that can jeopardize positive economic growth, a point the CCPA Saskatchewan Office has been at pains to make over the past few years. After two years of negative economic growth, the economic assumptions in the 2018 budget are betting that a return to positive economic growth will do much of the heavy lifting of fighting the deficit. While this is welcome, it further throws into question the wisdom of the 2017 budget cuts and the government’s embrace of austerity, all evidence to the contrary.

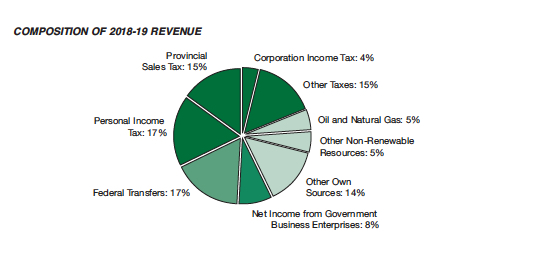

Also welcome is the government’s recognition that its planned corporate and personal income tax cut reductions were ill-advised and unsustainable. But even with these walk-backs, the paucity of the government’s current corporate income tax rate is reflected in the composition of revenues for the 2018 budget. As University of Saskatchewan Political Studies professor Charles Smith points out, the government received twice as much revenue from Crown Corporations ($1.1 billion) than all other corporations in Saskatchewan combined ($621 million). We would do well to remember this discrepancy, should the government float the desirability of further Crown privatizations in the future.

Simon Enoch is the Director of the Saskatchewan Office of the Canadian Centre for Policy Alternatives.

Saskatchewan is a wealthy province with a poverty problem. More than one-in-ten people live in poverty and our child poverty rate is above the national average. Dig into the data and you find that some populations disproportionately bear the brunt of poverty in Saskatchewan. Single parent families, new Canadians, persons with disabilities and Indigenous peoples are all more likely to live in poverty. Indigenous children are particularly vulnerable, with Saskatchewan’s rate of First Nations child poverty running as high as one-in-two, a number virtually unchanged over the past ten years.

Poverty means making choices between healthy food, safe housing, school supplies and transportation. It means poorer educational outcomes for children, higher demand on public services and reduced economic productivity. The 2015 Poverty Costs campaign calculated that leaving people in poverty costs Saskatchewan 3.8 billion per year, more than three times the current provincial budget deficit. Investing in affordable housing, accessible childcare, and adequate income can save our province money and improve the health, happiness, and quality of life in our communities. The family and social costs of poverty can be avoided, if we choose to act.

As individuals, we can support employees who pay a living wage and elect representatives who want to reduce poverty. Government commitments to poverty elimination can be fickle, however, with campaign promises forgotten once power is obtained. Ending poverty in Saskatchewan requires sustained action across multiple administrations. This issue is too important to be left to partisan politics.

Legislation would make sustained action the norm. By enshrining a goal in law, defining how success is measured, and setting out some initial actions, Saskatchewan can achieve the lowest poverty rate in Canada. Cabinet should be responsible for reporting on progress every year, the goal being to reduce poverty by 50% by 2024 with continuous reductions in the depth of poverty in the meantime. A similar target was recommended by the Advisory Committee on Poverty Reduction in 2015. The provincial government convened that expert group but failed to heed their advice, illustrating why we cannot depend on promises and good will to drive poverty elimination.

Over the past year, a coalition of anti-poverty advocates from across Saskatchewan has been developing An Act to Eliminate Poverty in Saskatchewan. It draws on existing work by reiterating the calls to action of Saskatchewan’s anti-poverty community, while also building a framework for implementation of those actions. It is modeled on similar pieces of legislation in other provinces but adds a human rights lens which highlights commitments our government has made under international law. This act would make poverty elimination a core responsibility of Cabinet, no matter who forms government.

All governments need to be held accountable for eliminating poverty and promises made during elections are too easy to break. We need our government to be bound by legislation if we want to end poverty in Saskatchewan. Review our draft anti-poverty act online.

Peter Gilmer is an advocate with the Regina Anti-Poverty Ministry who writes on behalf of Saskforward.

Preamble

Whereas poverty is not a natural phenomenon, but a consequence of political and structural forces over which governments have considerable influence;

Whereas poverty is an impediment to realizing the full economic, social, and personal health of Saskatchewan’s peoples;

Whereas living in poverty is particularly harmful to the health and development of children, and entails consequences which last well into adulthood;

Whereas experiences of poverty are disproportionately borne by Indigenous persons, and are a direct impediment to achieving reconciliation;

Whereas individuals experiencing poverty are best positioned to know what is needed for them to escape poverty;

Whereas the condition of poverty is contrary to the principles contained in the Charter of Rights and Freedoms;

Whereas Saskatchewan is obliged to demonstrate compliance with its international obligations under the International Covenant on Economic, Social and Cultural Rights;

Whereas Article 11 of this Covenant recognizes the right of everyone to an adequate standard of living for themselves and their families, including adequate food, clothing and housing and to the continuous improvement of living conditions;

Whereas Article 7 of the Covenant recognizes the right of everyone to the enjoyment of just and favourable conditions of work, which ensure all workers earn fair wages and a decent living for themselves and their families;

Whereas proposals such as adequate income security benefits, a living wage, quality and affordable housing and childcare are not just social policy concerns, but basic human rights;

Whereas the United Nations Committee on Economic, Social and Cultural Rights has been very critical of Canada and the provinces for not ensuring these rights in such a wealthy nation;

Whereas eliminating poverty would confer considerable health, economic and social benefits on Saskatchewan;

THE LEGISLATURE OF SASKATCHEWAN ENACTS AS FOLLOWS:

Chapter 1

Object, Definition & Objective

1. The object of this Act is to commit the Province of Saskatchewan to eliminating poverty across the province. To this end, the Act establishes a standard, measurable definition of poverty against which efforts will be evaluated. The Act also sets a timetable for reporting progress, identifies initial actions to be taken in the next two years, and creates a mandate for a permanent advisory committee on poverty elimination.

2. This Act also commits the Province of Saskatchewan to ensure that articles of the International Covenant on Economic, Social and Cultural Rights are acted upon and monitored.

3. For the purposes of this Act, “poverty” is defined as the condition of a human being who is deprived of the resources, means, choices and power necessary to acquire and maintain economic self-sufficiency.

4. For the purposes of this Act, the Market Basket Measure (MBM) is the indicator of poverty in Saskatchewan.

5. For the purposes of this Act, Saskatchewan’s objective shall be to reduce the number of people in poverty by 50% by the end of 2024, using the 2016 MBM as a baseline.

6. For the purposes of the Act, Saskatchewan’s objective is to show continuous reductions in the depths of poverty until its poverty reduction goals are met.

7. For the purposes of this Act, the Minister of Health is the lead ministry responsible for reporting on actions taken towards meeting the goals of this Act. Annually, the Minister shall set goals for reducing poverty and shall provide a report on the progress achieved. These reports shall be publicly available.

8. Where measures in this Act or in the provincial strategy to eliminate poverty require coordination among Ministries or actions by various Ministries, these shall be brought to Cabinet by the Minister of Health. These shall be discussed and coordinated by Cabinet or a sub-committee of Cabinet. Where such measures require budgetary allocations, the Minister of Finance shall direct Ministries to give high priority to including them in the provincial budget.

Chapter 2

Strategy

1. For the purposes of this Act, a provincial strategy to eliminate poverty will be established.

2. For the purposes of this Act, specific responsibilities of each Ministry will be identified in the strategy.

3. The provincial strategy is intended to guide Saskatchewan towards its goal of reducing poverty by 50% by the end of 2024.

4. The provincial strategy will consist of actions to be taken by the provincial government, in consultation and cooperation with regional and local partners, with special effort made to consult people with lived experiences of poverty in the design of actions.

5. To achieve the goals set out in this Act, the provincial strategy will be developed according to the following principles:

6. The provincial strategy shall be introduced in the Legislature no later than six months following the adoption of this Act.

Chapter 3

Actions

1. The actions contained in this section will be undertaken over the two years immediately following the Act’s implementation, and are in addition to other actions which will be defined in the strategy.The provincial government will implement an income security plan which ensures present benefits meet basic needs. As one element of this income security plan, the provincial government will design, implement, and evaluate a basic income pilot program:

3. The provincial government will establish a permanent Advisory Committee on Poverty Elimination responsible for advising Cabinet on updates to the province’s poverty elimination strategy and the actions identified therein.

4. The provincial government will, in collaboration with stakeholders, develop, implement and evaluate a Saskatchewan Housing Strategy which includes expansion of social housing, rent controls, rental unit quality inspections and housing first programs.

5. The provincial government will design, implement, and evaluate a provincial child care program for the entire province:

6. The provincial government will implement a $15 per hour minimum wage, with an incremental plan to move to an actual living wage.

The Saskatchewan government promised “transformational change”… Instead we got a mean-spirited austerity budget that requires sacrifices from the many and delivers benefits to the few. It doesn’t have to be this way. For a government that prides itself on making “tough choices” this doesn’t seem that tough.

John Clarke speaks on Saskatchewan’s austerity budget and how to fight back.

As an organizer with the Ontario Coalition Against Poverty (OCAP), John Clarke has been involved in poor people’s movements for over 25 years. He first became active in anti-poverty struggles in 1983, when he helped form the Union of Unemployed Workers in London, Ontario. In 1989, he was among the organizers of a province-wide March Against Poverty that helped force the Liberal government of the day to increase social assistance rates. Since 1990, John has been a Toronto-based organizer with OCAP, which has played a leading role in mobilizing against policies of economic violence. OCAP has close links with the Irish Housing Network, and John recently traveled to the UK to observe and learn from anti-austerity movements there.

In December, SaskForward began an online public consultation process that asked people across the province to answer the question, “What ‘transformational change’ would you introduce to make Saskatchewan a happier, healthier, and more prosperous place for all?”

After receiving over one hundred submissions from individuals and organizations and hosting a policy summit and discussion with over 120 participants, SaskForward releases Saskatchewan Speaks: Policy Recommendations for Transformational Change. This report puts forward a series of policy recommendations based on the ideas and suggestions Saskatchewan people shared with us.

Three key messages emerged from the ideas shared with us during the consultation process. The first is that public spending that addresses the root causes of social problems needs to be viewed as an investment that will save us money in the long run. While cuts to social spending may improve balance sheets in the short-term, they will create long-lasting health and social impacts that outweigh any initial cost-saving. Indeed, there was widespread consensus that social program cuts – even in spite of the current deficit – were ill-advised and counter-productive to the overall health of the province.

The second message that emerged from the submissions was that respondents want to see much more emphasis on new revenue streams and sources. Saskatchewan’s revenues as a share of GDP have declined from 22.4 percent in 2007 to 17 percent in 2015. Respondents were unified in their call for the government to consider new revenue sources, with a strong preference for increased progressivity in the provincial income tax system.

Lastly, there was a real appetite for a grand vision for the province, particularly in regards to energy and the environment. Many respondents believe that Saskatchewan – with its ample renewable resources and provincial crown corporations – is uniquely situated to take advantage of the nascent green energy economy given the appropriate direction and investment by the provincial government.

Despite the province’s current economic woes, there was a tremendous optimism in the ability of the province to become a more just and sustainable place in the future. We want to thank the people of Saskatchewan for sharing their visions for the province with SaskForward. We certainly hope the government and the rest of the Saskatchewan public will seriously consider the thoughtful and inspiring ideas we have collected in this report.

Download the full report: SaskForward – Sask Speaks (03-15-17)-4